Introduction:

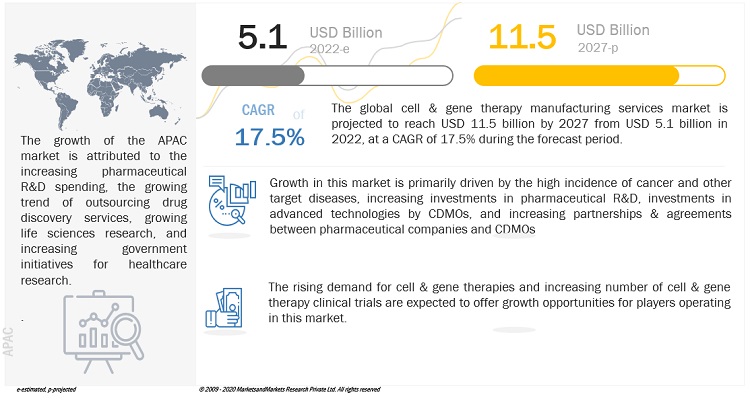

The Cell & Gene Therapy Manufacturing Services Market is on the verge of a significant expansion, with revenue estimated at $5.1 billion in 2022 and expected to reach a staggering $11.5 billion by 2027. This remarkable growth, at a CAGR of 17.5% from 2022 to 2027, is being fueled by various factors that are shaping the landscape of cell and gene therapy manufacturing.

Download PDF Brochure-https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

Driving Factors:

-

Prevalence of Diseases: One of the primary drivers of this market's growth is the increasing prevalence of diseases, especially cancer. As the global population faces a higher burden of diseases, there's a growing demand for innovative therapies like cell and gene therapies.

-

R&D Spending: Pharmaceutical companies are pouring substantial investments into research and development (R&D) activities related to cell and gene therapies. This surge in R&D spending is leading to the development of cutting-edge therapies and solutions.

-

Partnerships and Agreements: Collaboration and partnership agreements between pharmaceutical companies and Contract Development and Manufacturing Organizations (CDMOs) are playing a pivotal role in advancing the field of cell and gene therapy. These partnerships facilitate the exchange of knowledge, resources, and expertise, ultimately boosting the market.

Challenges:

However, amidst this remarkable growth, the Cell & Gene Therapy Manufacturing Services Market faces challenges related to operational costs. The complexity of producing cell and gene therapies, including logistical challenges, low production volumes, and manual processes, makes these treatments expensive. Manufacturing costs for cell therapy can exceed $100,000 per patient, while gene therapy costs can range from $500,000 to $1 million, excluding R&D expenses. This affordability issue poses a significant challenge for both manufacturers and healthcare providers.

Growth Opportunities:

Despite these challenges, the market offers promising opportunities:

-

Private and Public Investments: The cell and gene therapy industry is attracting substantial private and public investments. Private equity and capital investment in life sciences have been steadily increasing. For example, investment in this sector soared from $362 million in 2020 to nearly $68 billion in 2021. This surge in funding is expected to drive demand for outsourcing services, thereby boosting the growth of cell and gene therapy manufacturing services.

-

CDMO Expansion: Contract development and manufacturing organizations (CDMOs) are expanding their capacities to meet the growing demand for cell and gene therapies. These expansions are crucial in increasing production yields and lowering product costs, making these therapies more accessible and cost-effective.

Segment Dominance:

In 2021, the cell therapy segment dominated the cell & gene therapy manufacturing services market. Cell therapies are showing significant potential in treating various diseases, including cancer, autoimmune disorders, and infectious diseases. The availability of funding for new cell lines and the strategic growth initiatives of companies are further propelling the growth of the cell therapy segment.

Regional Insights:

North America held the largest share of the market in 2021. The region's dominance can be attributed to the rising incidence of cancer and a strong focus on research in cancer and stem cell therapies. Europe and the Asia Pacific followed closely, indicating the global nature of the cell and gene therapy manufacturing services market.

Key Players:

Key players in this market include Lonza, Catalent, Thermo Fisher Scientific, Charles River Laboratories, WuXi AppTec, Merck KGaA, Takara Bio Inc., Nikon Corporation, FUJIFILM Holdings Corporation, Oxford Biomedica plc, and Cell and Gene Therapy Catapult.

Download PDF Brochure-https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=180609441

In conclusion, the Cell & Gene Therapy Manufacturing Services Market is in the midst of a remarkable growth phase, driven by the increasing prevalence of diseases, substantial investments, and strategic collaborations. While challenges related to operational costs exist, the market is poised for significant expansion in the coming years, offering new hope for patients battling various diseases.